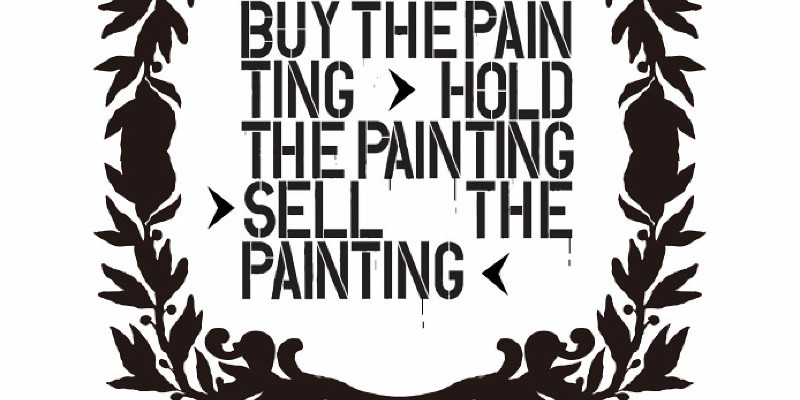

When you are ready to generate an offer to buy property, present a realistic, comprehensive document to the vendor that shows you’re serious and you’ve done your homework. Include all that you want to address, even if it seems insignificant. […]

Continue Reading